DUBAI, UAE, March 3, 2025 /PRNewswire/ — Bybit, the world’s second-largest cryptocurrency exchange by trading volume, has released its latest Bybit Commodity Insight Report. The report provides key insights into the macroeconomic and geopolitical trends driving gold’s bullish trajectory, analyzing the factors that could push the precious metal to new all-time highs.

Key Highlights:

Bullish Outlook: Gold is expected to surpass $3,000 per ounce in 2025, supported by strong macroeconomic and geopolitical factors.Inflation Hedge: Persistent inflation above the Federal Reserve’s target strengthens gold’s role as a hedge against currency devaluation.Monetary Policy Shifts: Anticipated U.S. interest rate cuts could boost gold’s appeal over interest-bearing assets.Geopolitical Tensions: Global conflicts, including U.S.-China tensions and the Russia–Ukraine war, are driving demand for safe-haven assets.Central Bank Demand: Record-breaking gold purchases, especially by China and Russia, provide structural support for higher prices.Technical Momentum: Breaking past $3,000 could accelerate gains toward $3,200–$3,500.Investor Confidence: Strong ETF inflows and speculative positioning signal a bullish market sentiment.

Macroeconomic Drivers

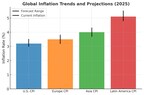

With inflation projected to remain above 2%, gold continues to serve as a hedge against declining purchasing power. The Federal Reserve’s expected rate cuts could further increase demand, as lower real interest rates make gold more attractive than fixed-income assets.

Geopolitical Uncertainty

Ongoing conflicts and global instability are reinforcing gold’s safe-haven appeal. Historically, gold has outperformed during periods of geopolitical stress, with investors turning to it as a hedge against uncertainty. The current environment suggests this trend will continue.

Central Bank Accumulation

Central banks purchased over 1,000 metric tons of gold in 2024, a trend expected to persist as countries like China and Russia diversify away from the U.S. dollar. This steady accumulation supports prices and limits downside risk.

Technical Strength & Market Sentiment

Gold remains in a strong uptrend, with key resistance levels in focus. A break above $3,000 could trigger further gains, while ETF inflows and rising futures positions indicate strong investor confidence.

Conclusion

Gold’s path to $3,000 is driven by inflation, central bank demand, geopolitical uncertainty, and positive technical indicators. As global instability persists, gold’s status as a safe-haven asset is expected to strengthen.

For a deeper analysis of these trends, access the full Bybit Commodity Insight Report from Bybit.

#Bybit / #TheCryptoArk /#BybitResearch/#BybitLearn

About Bybit

Bybit is the world’s second-largest cryptocurrency exchange by trading volume, serving a global community of over 60 million users. Founded in 2018, Bybit is redefining openness in the decentralized world by creating a simpler, open and equal ecosystem for everyone. With a strong focus on Web3, Bybit partners strategically with leading blockchain protocols to provide robust infrastructure and drive on-chain innovation. Renowned for its secure custody, diverse marketplaces, intuitive user experience, and advanced blockchain tools, Bybit bridges the gap between TradFi and DeFi, empowering builders, creators, and enthusiasts to unlock the full potential of Web3. Discover the future of decentralized finance at Bybit.com.

For more details about Bybit, please visit Bybit Press

For media inquiries, please contact: [email protected]

For updates, please follow: Bybit’s Communities and Social Media

Discord | Facebook | Instagram | LinkedIn | Reddit | Telegram | TikTok | X | Youtube

View original content to download multimedia:https://www.prnewswire.com/apac/news-releases/bybit-report-gold-set-to-surpass-3-000-in-2025–302390048.html

SOURCE Bybit