MANILA, Philippines, Nov. 8, 2025 /PRNewswire/ — The Philippines’ leading finance super app, GCash, has introduced a new game-changing product on November 5, 2025 — the GCash Virtual US Account, which enables Filipinos to receive payments and remittances in US Dollars directly to their GCash e-wallet account, without needing a US-based bank account or incurring additional charges.

The game-changing service also addresses a persistent pain point for Filipino freelancers who often lose a portion of their income to costly fees, reducing their take-home pay and delaying access to funds they rely on for daily expenses.

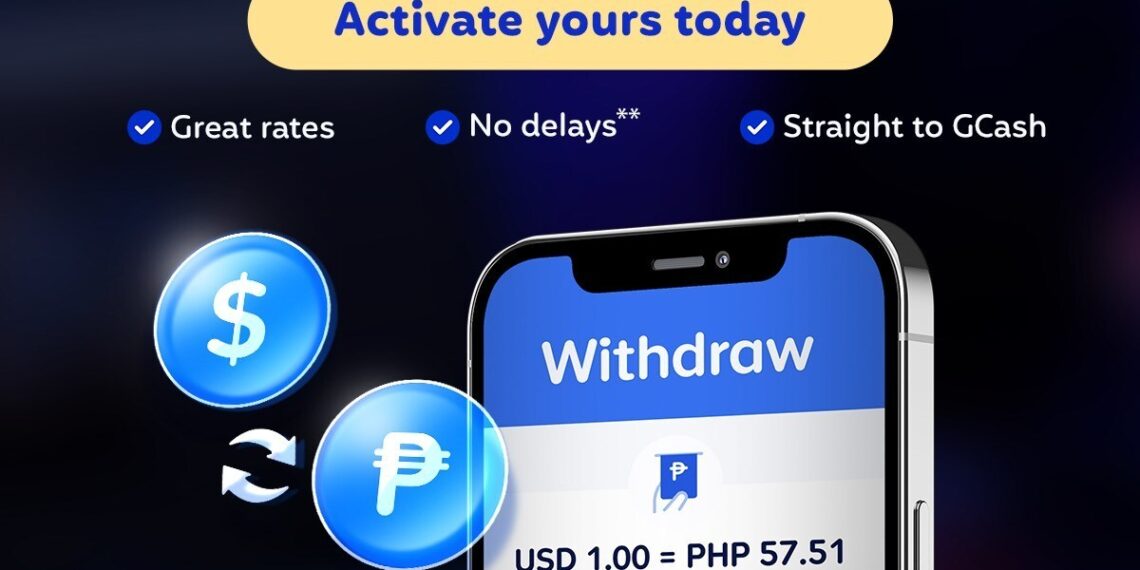

The GCash Virtual US Account, powered by global payments network Meridian1, promises reduced platform fees and forex costs, allowing gig workers to have bigger take-home pay, and enabling all Filipinos to maximize the remittances they receive. In addition, the GCash Virtual US Account eliminates high withdrawal fees and hidden charges.

“With the GCash Virtual US Account, GCash users can hold US dollars and only convert to Philippine pesos when they need to. This enables them to avoid unnecessary fees and convert their money at their most favorable time,” GCash General Manager for International Paul Albano said.

Users can instantly receive transfers from the US right into their e-wallet, giving them immediate access to their USD funds, which can then be converted into PHP at competitive exchange rates — all within the GCash app.

Fully verified GCash users are eligible for account opening.

This feature is seen to boost inflows of dollars into the country from the US, which is a top remittance source for the Philippines. According to the Bangko Sentral ng Pilipinas, about 40% of cash remittances from January to August this year came from the US.

Through GCash Virtual US Account, GCash strengthens its goal of enabling Filipino freelancers by breaking barriers to financial access through faster, more affordable cross-border payments for gig workers.

1GCash Virtual US Accounts are issued and maintained by Meridian Payments US under a “for benefit of” arrangement. These are not bank accounts and do not qualify as deposits; hence, they are not covered by any deposit insurance schemes.