Enables Real-Time Trading of Traditional Assets During Historic Event-Driven Market Volatility and Adoption of Prediction Markets

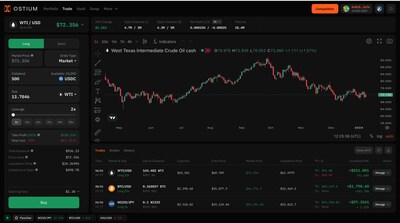

LONDON, Oct. 18, 2024 /PRNewswire/ — Ostium Labs today announced the public mainnet launch of its onchain trading platform, offering traders unprecedented access to global macro markets during a period of global event-driven volatility, marked by speculation around the U.S. Presidential election. Ostium enables perpetuals trading on traditional market currencies, commodities, and indices in real time, markets uniquely affected by events like interest rate changes and geopolitical outcomes.

The trading platform meets the needs of a market grappling with an uncertain U.S. Presidential election, the prospect of escalation in the Middle East, and shifting monetary policies. These dynamics have led to dramatic price movements and dislocations in commodities and currencies, offering unique opportunities for traders chasing volatility. Gold, generally seen as a “flight-to-safety” asset, has skyrocketed past all-time highs as domestic political and economic uncertainty has increased dramatically over the last months. Ostium is the only platform to offer real-time trading across diverse assets including Gold, Copper, and Oil to any user with a crypto wallet.

“Our thesis has long been that this new, more volatile macro paradigm will open up unprecedented opportunities for event-driven trading,” said Kaledora Kiernan-Linn, co-founder and CEO of Ostium Labs. “The success of prediction markets as a forum for traders to express their views on world events is only the tip of the iceberg. Event-driven trading will expand beyond betting on event outcomes to betting on the movements of the most liquid markets in the world – the forex, commodities and global index markets – using event probabilities as critical trading signals.”

“Ostium is perfectly positioned to capitalize on the growing demand for macro event-driven trading,” said Marc Bhargava, Managing Director at General Catalyst. “By enabling one-click trades on traditional assets with only a wallet, Ostium is democratizing access to global markets in a way we haven’t seen before. This isn’t just another crypto play – it’s a gateway for traders to efficiently capitalize on macro news across traditional financial markets, all with the speed and accessibility of decentralized finance.”

Ostium’s novel approach has already captured traders’ attention during its private Mainnet phase since August:

Ostium’s FX and commodities perpetuals volumes surged 550% during the week following China’s new Quantitative Easing policy announcement and rising Middle Eastern tensions (9/27-10/3)Open Interest on Ostium’s WTI Crude Oil perpetuals hit caps 6x in the 10 days following Iran’s ballistic missile attack on Israel and ensuing fears of a retaliatory strike on Iranian oil fieldsOstium’s Real World Asset (RWA) volumes have outpaced crypto volumes 4x in recent weeks of macroeconomic instability, and 8x on days with heightened macroeconomic instability

“The next evolution of event-based trading isn’t about predicting outcomes in isolation, but understanding and capitalizing on how these events influence the world’s largest and most liquid markets,” Kiernan-Linn added. “We’re building a new trading experience where anyone can trade any strategy on any asset––all with just a wallet.”

Ostium leverages a unique design: a non-custodial, onchain perpetual futures market that disintermediates the centralized liquidity and exposure management characteristic of legacy FX/CFD brokers through the introduction of dynamic funding fees, allowing users to gain exposure to commodities, index and forex markets without the exchange managing the book. This innovative architecture positions Ostium to radically democratize access to macro-driven markets and compete against legacy, centralized FX/CFD brokers for the 80 million and growing monthly-active userbase, and the $50 trillion traditional asset retail trading market.

“A lesser known fact is that perpetuals are in fact quite similar to instruments that have been offered by FX brokers for years – cash-settled, non-expiring, synthetic primitives closely tracking the price of an underlying asset, enabling easy both long and short exposure – traded by over 50 million monthly active forex traders globally,” said Marco Antonio Ribeiro, co-founder and CTO of Ostium Labs. “However, onchain perpetuals are a fundamentally better instrument due to the introduction of funding rates, which incentivize market balance, and the ability to trade self-custodially, improving the adversarial market structure between platform and user. We strongly believe the retail FX trading market will be disrupted in the next 5 years and that it will be done by perps.”

Ostium’s shared liquidity model, unique fee architecture, and custom RWA price oracle facilitate perpetual creation on any asset with a liquid underlying off- or on-chain spot market. This flexible architecture enables rapid listing expansion across asset classes.

With its mainnet launch, Ostium aims to fill a critical gap for narrative-driven trading in the prosumer market. The platform’s ability to offer one-click, large-scale trades on macro events positions it as a leader in an underserved category. As global markets face increasing tumult, Ostium provides a novel platform to navigate and capitalize on these dynamic conditions, setting a new standard for accessible and flexible trading in an event-driven age.

For more information about Ostium and to start trading, visit www.ostium.io.

About Ostium:

Ostium is building Real World Asset perpetuals trading infrastructure to enable the ‘perpification’ of non-digital assets. The protocol leverages an in-house Real World Asset oracle network and pool-based on-chain liquidity engine to facilitate onchain exposure to traditional market assets. With founders and team members previously from Harvard, Bridgewater, and BlackRock, Ostium is backed by leading investors including LocalGlobe, General Catalyst, Susquehanna (SIG), and Alliance DAO.

View original content:https://www.prnewswire.com/apac/news-releases/ostium-launches-novel-macro-trading-platform-amidst-growth-in-global-events-based-trading-302280200.html

SOURCE Ostium Labs Co