Borderless dollar banking—built different for people who live and work everywhere

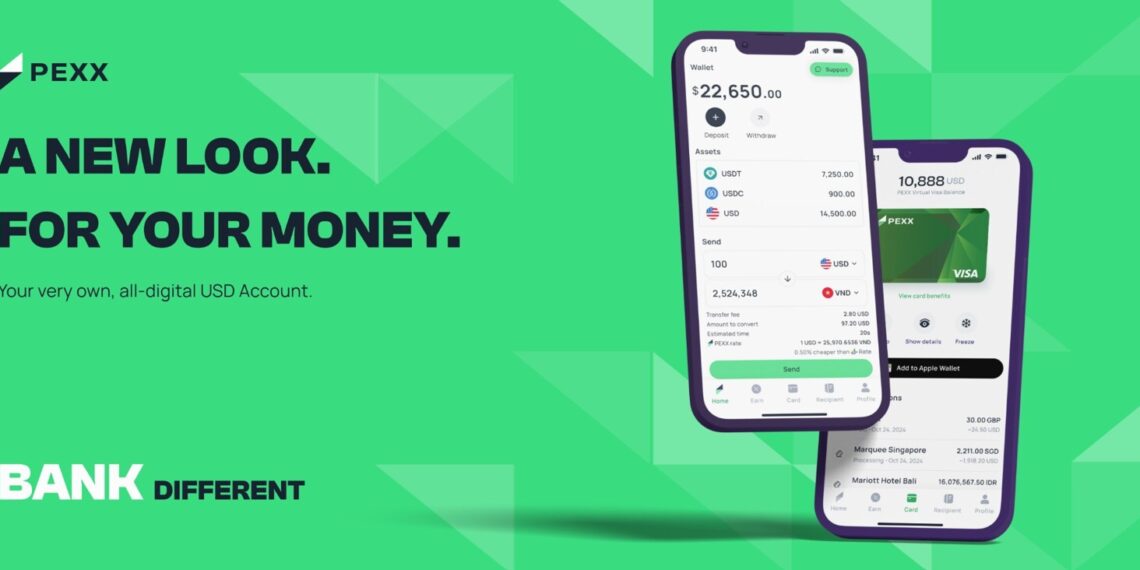

SINGAPORE, June 10, 2025 /PRNewswire/ — PEXX, the cross-border USD platform built for today’s mobile workforce, has opened its full neo-banking suite to customers in more than 50 countries. The launch delivers four connected products that let users Bank Different, Pay Different, Send Different, and Earn Different—replacing legacy bank delays, paperwork, and hidden fees with real-time settlement and transparent pricing.

Since its initial launch in 2024, PEXX has empowered users across 50+ countries to move money faster, easier, and more affordably than traditional finance.

With its expanded platform, PEXX fills three gaps no single provider closes:

- What legacy banks won’t offer: a full-feature USD account you can open from anywhere—no branch visits, no U.S. residency required.

- What crypto exchanges can’t deliver: fast, global crypto-to-fiat transfers that arrive as spendable dollars, off-chain and straight into bank accounts.

- What most neo-banks still lack: on-demand tokenized U.S.-Treasury yield (T-Bills) and real-time stablecoin settlement, working seamlessly and interchangeably with your dollars and Visa card.

Together, these capabilities hand the borderless, digital-first generation one modern way to hold, move, and grow dollars—wherever life goes next.

Banking Done Different

USD and Stablecoins Everywhere. All at Once

PEXX gives users everything they expect from a USD bank—without the barriers.

Key features include:

- Borderless Virtual USD Accounts

- Open a full-featured digital USD account with zero monthly fees, no minimums, and instant onboarding using just a passport and phone—no U.S. residency or SSN required.

- Deposit in USDT or USDC, send and receive USD via SWIFT, ACH, and Fedwire from anywhere.

- Daily Interest Wallet

- Earn up to 3.5% APY automatically on idle balances, powered by tokenized U.S. Treasury Bills via regulated third-party infrastructure.

- No lockups. No hidden risks. Yield is paid daily.

- PEXX Card

- Spend USD, USDT, or USDC at 150M+ merchants worldwide with your free global Visa debit card—from Uber Eats and Alipay to your Netflix subscription.

- Free instant Visa virtual card with a flat 1.2% FX fee.

- Global Off-Ramp Transfers

- Send USD and stablecoins directly to bank accounts in over 50 countries, typically clearing within minutes, sometimes seconds, and always within 24 hours.

- Industry-leading FX rates and real-time Google FX pricing for full transparency.

The Best Rates in the Game

In key payment corridors, PEXX has developed stablecoin payment infrastructure to outperform leading global fintech players.

Illustration of comparison below on 2 June 2025:

|

Corridor |

Amount Sent |

Recipient Gets |

Value Over Other Competitors |

Settlement Time |

|

USD → INR |

$1,000 |

₹85,887 |

+₹1,069 (~ USD 12.51) |

30 seconds |

|

USD → VND |

$1,000 |

₫25,958,555 |

+₫161,684 (~ USD6.21) |

2 minutes |

|

USD → IDR |

$1,000 |

Rp16,317,838 |

Rp132,517 (~USD8.12) |

30 seconds |

By pairing real-time FX with zero transfer fees, PEXX lets users keep 1–2% more on every transfer—ideal for freelancers, businesses, and global citizens.

Built for the Rest of Us

PEXX is accessible worldwide—purpose-built for:

- Freelancers, remote workers, and creators earning in USD and stablecoins.

- Expats, students, and digital nomads managing cross-border payments.

- Startups and SMEs paying global teams or suppliers.

- Everyday users who want to store—and grow—USD securely.

“Banking Without Borders”

“PEXX gives you everything you expect from a USD bank—except the borders, high fees and friction. Our mission is simple: if you’ve got a passport and a phone, you should have full access to USD, just like anyone else. That’s the future we’re building.”

— Marcus Lim, CEO and Founder of PEXX

Seed Funding & Growth Roadmap

PEXX recently closed over $4 million seed round led by TNB Aura, with participation from Antler and LongHash Ventures, alongside angel investors including Dexter Lo, Kenneth Low.

This strategic funding will fuel the company’s next phase—spanning global licensing, product innovation, and expansion across Asia, Latin America, and the Middle East.

PEXX also partners with Fireblocks for secure asset custody and Ripple for ultra-fast global blockchain payments. As an AUSTRAC-registered Digital Currency Exchange (DCE) and remittance dealer and Money Service Business in the US, PEXX combines cutting-edge technology with regulatory compliance to deliver a truly borderless banking experience.

About PEXX

PEXX is a next-generation USD platform and neo-banking suite built for the global generation. Founded in 2024, it delivers borderless access to U.S. dollars through interest-bearing wallets, real-time transfers, and a globally accepted Visa card—powered by stablecoins, tokenized T-Bills, and blockchain settlement. From freelancers to founders, PEXX brings Wall-Street-level financial tools to everyone, everywhere—showing there’s a smarter, truly different way to send, spend, earn, and bank your money.

To download the app, visit https://pexx.com.

Telegram Support: https://t.me/PEXXOfficial