|

AI and Leading-edge Technology Transitions are Expected to Drive Three Consecutive Years of Growth through 2026

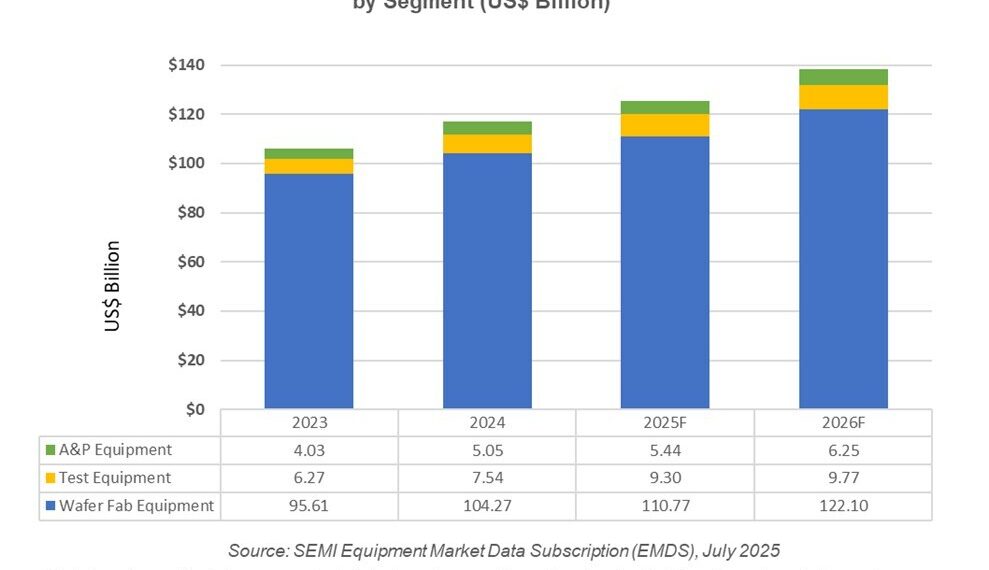

MILPITAS, Calif., July 22, 2025 /PRNewswire/ — SEMI today announced that global sales of total semiconductor manufacturing equipment by original equipment manufacturers (OEMs) are forecast to set a new industry record of $125.5 billion in 2025, a 7.4% year-on-year increase, according to its Mid-Year Total Semiconductor Equipment Forecast – OEM Perspective. Semiconductor manufacturing equipment growth is expected to continue in 2026, with sales projected to reach a new high of $138.1 billion, driven by leading-edge logic, memory and technology transitions.

“Following strong growth in 2024, global semiconductor manufacturing equipment sales are forecast to expand again this year and set a new record in 2026,” said Ajit Manocha, SEMI president and CEO. “While the semiconductor industry is closely monitoring macroeconomic uncertainty, AI-fueled demand for chip innovations is driving investments in capacity expansions and leading-edge production.”

Semiconductor Equipment Sales by Segment

After registering a record $104.3 billion in sales last year, the Wafer Fab Equipment (WFE) segment, which includes wafer processing, fab facilities and mask/reticle equipment, is projected to increase 6.2% to $110.8 billion in 2025. This upward revision from SEMI’s 2024 Year-End Equipment Forecast of $107.6 billion is largely driven by increased sales to foundry and memory applications. Looking ahead to 2026, WFE segment sales are projected to expand 10.2%, reaching $122.1 billion. The growth is attributed to capacity expansions in leading-edge logic and memory to support AI applications, as well as ongoing process technology migrations across major segments.

The back-end equipment segment is anticipated to continue its strong recovery that began in 2024. Following that year’s robust 20.3% year-on-year growth, sales of semiconductor test equipment are projected to rise another 23.2% in 2025 to a new record of $9.3 billion. Assembly and packaging equipment sales grew 25.4% in 2024 and are forecast to increase 7.7% to $5.4 billion in 2025. Back-end equipment segment expansion is expected to continue in 2026, with test equipment sales rising 5.0% and assembly and packaging sales increasing 15.0%, marking three consecutive years of growth. The expansion is driven by significant increases in the complexity of device architectures and the robust performance requirements for AI and high-bandwidth memory (HBM) semiconductors. However, growth in this segment is partially offset by continued weakness in the automotive, industrial and consumer end markets.

WFE Sales by Application

WFE sales for foundry and logic applications are expected to show stable growth of 6.7% year-over-year to $64.8 billion in 2025, driven by robust demand for advanced nodes. In 2026, the segment is forecast to grow another 6.6%, reaching $69.0 billion. The growth will be supported by increased capacity expansion purchases and rising demand for leading-edge technologies as the industry progresses toward high-volume manufacturing at the 2nm gate-all-around (GAA) node.

Memory-related capital expenditures are projected to see an increase in 2025 and to demonstrate continued growth in 2026. NAND equipment sales continue to recover from a sharp contraction of 2023. After registering a modest 4.1% increase in 2024, the NAND equipment market is expected to see 42.5% expansion to $13.7 billion in 2025 and 9.7% to $15.0 billion in 2026, driven by advancements in 3D NAND stacking and capacity expansion. Meanwhile, DRAM equipment sales, which surged 40.2% in 2024 to $19.5 billion, are projected to grow at 6.4% and 12.1% in 2025 and 2026, respectively, supporting investments in HBM for AI deployment.

Semiconductor Equipment Sales by Region

Mainland China, Taiwan and Korea are expected to remain the top three destinations for equipment spending through 2026. China continues to lead all regions over the forecast period, though sales in the region are expected to decline from 2024 record investments of $49.5 billion. All other regions except Europe are expected to see significant increases in equipment spending starting in 2025. However, heightened trade policy risks may impact the pace of growth across regions.

The SEMI forecast is based on collective input from top equipment suppliers, the SEMI Worldwide Semiconductor Equipment Market Statistics (WWSEMS) data collection program, and the industry-recognized SEMI World Fab Forecast database.

About SEMI Market Data

The Equipment Market Data Subscription (EMDS) from SEMI provides comprehensive market data for the global semiconductor equipment market. A subscription includes three reports:

- Monthly SEMI North American Billings Report, an early perspective of equipment market trends

- Monthly Worldwide Semiconductor Equipment Market Statistics (WWSEMS), a detailed report of semiconductor equipment billings for seven regions and more than 22 market segments

- Bi-annual Total Semiconductor Equipment Forecast – OEM Perspective, an outlook for the semiconductor equipment market

For more information on the report or to subscribe, please contact the SEMI Market Intelligence Team at [email protected]. Details on SEMI market data are available at SEMI Market Data.

About SEMI

SEMI® is the global industry association connecting over 3,000 member companies and 1.5 million professionals worldwide across the semiconductor and electronics design and manufacturing supply chain. We accelerate member collaboration on solutions to top industry challenges through Advocacy, Workforce Development, Sustainability, Supply Chain Management and other programs. Our SEMICON® expositions and events, technology communities, standards and market intelligence help advance our members’ business growth and innovations in design, devices, equipment, materials, services and software, enabling smarter, faster, more secure electronics. Visit www.semi.org, contact a regional office, and connect with SEMI on LinkedIn and X to learn more.

Association Contact

Sherrie Gutierrez/SEMI

Phone: 1.831.889.3800

Email: [email protected]